During college, you have the chance to try new courses, build friendships, and, if you’re lucky, live away from home. Nevertheless, when you have such options, it’s important to manage your money well, and doing so for the first time may feel stressful.

Planning your finances in advance will prevent money problems and let you have more fun in college. Here are some basic and easy things you can do to avoid being an unlucky, broke student.

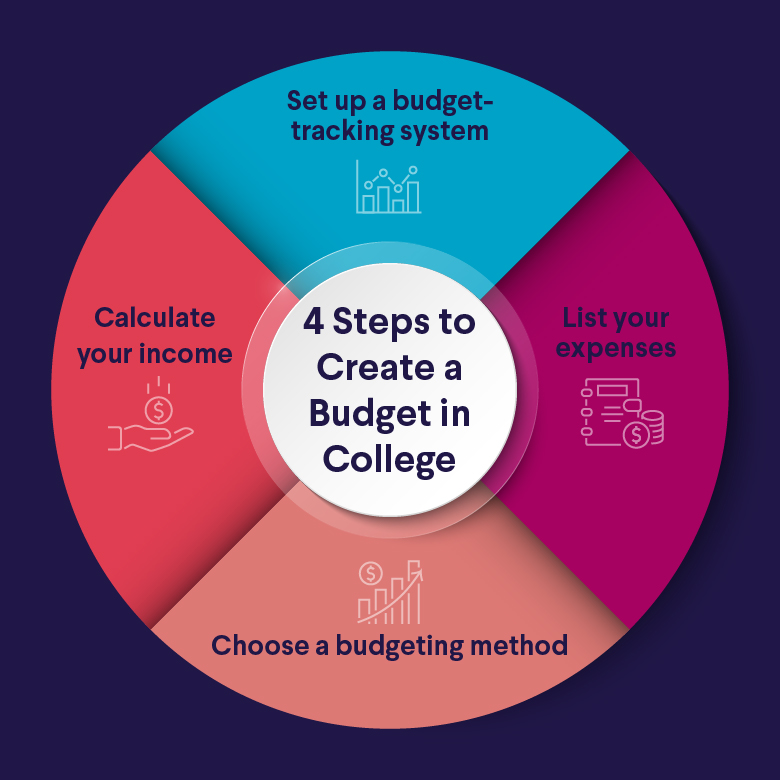

1. Keep Track of What You Earn and Spend

The first thing to find out is your income, whether you earn it from a job, merit-based scholarships, or family members. Then, pay attention to where every dollar goes. Whatever you have to pay for each month, put it on the list, whether that’s rent, groceries, coffee, or services. You can use apps like Mint or just keep a simple list—it doesn’t have to be fancy!

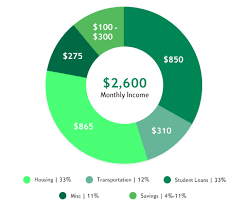

2. Make a Realistic Monthly Budget

When you are sure about your spending and your income, design a budget that works for you. Sort your money into separate groups for rent, eating, transportation, reading, and things you do for fun. Think about what you really need and what you’d like to have, and put aside some funds for surprises.

3. Focus on What You Really Need

Trying to buy new gadgets, fancy clothes, and go out often can be appealing, but don’t forget that rent, food, and textbooks come first. After you know how much you have, you can see how much you can spend on extras without burdening your pocket.

4. Take Advantage of Student Discounts

Students can find many deals on things such as cinema tickets, travel by public transport, and software subscriptions. Always carry your student ID and ask if a discount is available—you might be surprised how much you can save!

5. Cook More, Eat Out Less

Eating out frequently adds up fast. Cooking your own meals, even simple ones, can save you a lot of money—and it’s usually healthier too! If you assemble your meals at the start of the week, you’ll probably avoid overspending on pricey fast food.

6. Be Careful with Credit Cards

If you handle credit cards carefully, they can help your credit score, but if you’re not careful, you could end up owing money. Charges planned expenses on them and pay all the money back each month to avoid paying any more fees.

7. Enjoy Free or Cheap Activities

Check for activities like concerts or lectures offered around your campus or town at no cost or for a little money. You can have fun, socialize, and save money with these activities.

8. Save Something, Even if it’s small

If you can, save a small amount each month, even if it seems little. A little money saved helps you deal with sudden surprises and teaches you better money habits for the future.

9. Think Twice Before Buying

Be sure to question your need for an item before paying money for it. Sometimes it’s helpful to think about a purchase for a day or two before buying it.

10. Review Your Budget Often

So much can change with your financial situation; therefore, remember to go over your budget often. Change how you budget each month to remain organized and keep unexpected costs from creeping up.

Final Thoughts

Even though budgeting may seem like something you don’t want, it’s really a smart way to manage your money better and feel much less anxious. If you track your spending and make a budget, you’ll have more money for the things you enjoy in college.

Start small, stay consistent, and watch how good budgeting makes your college journey smoother and more enjoyable!