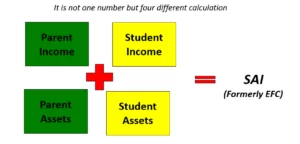

If you’re planning to study in the U.S. and are hoping for financial aid, there’s something new you need to understand: the Student Aid Index (SAI). This number is now a key part of how the U.S. government and colleges figure out how much help a student should get.

Starting with the 2024–25 academic year, the SAI has officially replaced the Expected Family Contribution (EFC). This change is part of a major effort to make the financial aid process easier and more accurate for students and families.

Let’s break down what the Student Aid Index really is, how it’s calculated now, and what these new rules mean for you.

What Is the Student Aid Index (SAI)?

Think of the SAI as a financial score that helps determine how much federal aid (like grants, loans, and work-study) you may qualify for when applying to U.S. colleges.

The main idea is simple:

- You have a better chance of receiving financial aid if your SAI is lower.

- A higher SAI means colleges might assume you can pay more out of pocket.

📝 Important Note: SAI can even be a negative number (as low as –1500), which wasn’t possible under the old system!

What’s Changed in the SAI Calculation?

The SAI brings several big changes compared to the old EFC system. Here’s what’s new in 2025:

1. No More Discount for Multiple Students in College

Old Rule:

Families with more than one child in college at the same time got a break—their expected contribution was split.

New Rule:

This discount is gone. Now, each student’s aid is calculated separately. Therefore, you may receive less aid than you did previously if you have siblings enrolled in college.

2. Pell Grants Linked Directly to SAI

Your SAI and your family’s income level are now closely related to your eligibility for a Pell Grant:

- Your SAI and your family’s income level are now closely related to your eligibility for a Pell Grant.

- Families at or near the poverty line (based on family size) may automatically qualify for partial or full aid.

This is a big win for lower-income students!

3. Automatic IRS Data Sharing Is Required

When filling out the FAFSA, students and parents must agree to share their tax information directly from the IRS.

Why this matters:

- Less manual entry and fewer errors.

- Speeds up FAFSA processing.

- However, there will be no exceptions to your eligibility for federal assistance if you refuse to give your consent.

4. New Rule for Divorced or Separated Parents

In the past, the parent who reported income was the one with whom the student lived the most.

Now:

The parent who provided the most financial support during the past year is the one who must report their income. This could affect your aid amount, especially if one parent earns more than the other.

5. More Income Protection for Families

The government has increased income protection allowances (IPAs), meaning:

- A larger portion of your family’s income is not counted in the SAI.

- This could result in a lower SAI, especially for middle-income families.

The goal is to better reflect the real-life cost of living and make the system fairer.

How Is Your SAI Used?

Colleges utilize your SAI as follows after calculating it:

Your Financial Need = College Cost – Your SAI

For example:

- If a college costs $40,000 per year and your SAI is $2,000

→ Your financial need is $38,000

That need is used to build your aid package—like Pell Grants, federal loans, or work-study jobs.

What Should Students Do?

Here’s how to stay ahead of the game:

- Fill out the FAFSA early (as soon as it opens).

- Be ready to share IRS tax info through the FAFSA tool.

- Use the FAFSA estimator to see your likely aid results.

- Update the paperwork if your family’s financial circumstances change.

- Apply for scholarships and state-level aid too, not just federal.

Final Thoughts

A significant step toward a more open and student-friendly financial aid procedure is the switch from EFC to SAI.While some students might see changes in how much aid they receive, the overall aim is to make federal aid more accessible, especially for those who need it most.

Understanding the new SAI rules can help you prepare smarter, apply with confidence, and take full advantage of the financial support available.